Bank Teller Training

Looking for a rewarding career in the banking industry. This program is designed to provide students with a comprehensive understanding of banking operations, financial services, and the practical skills required to excel as professional bank tellers.

Whether students aspire to become bank tellers, pursue further education in finance, or enter the financial services sector, this course provides a solid foundation in bank teller training and financial services. Students will gain the skills, knowledge, and professionalism needed to excel in a dynamic and customer-focused banking environment.

Unlock the vault to a successful banking career, where hands-on training, financial expertise, and customer service skills combine to prepare you for a pivotal role in the heart of financial institutions.

Program Objectives

-

Explore the fundamental principles of banking, financial institutions, and the role of bank tellers.

Gain insights into the diverse range of financial services offered by banks

-

Develop exceptional customer service skills, emphasizing effective communication and problem-solving.

Understand the importance of building and maintaining positive customer relationships.

-

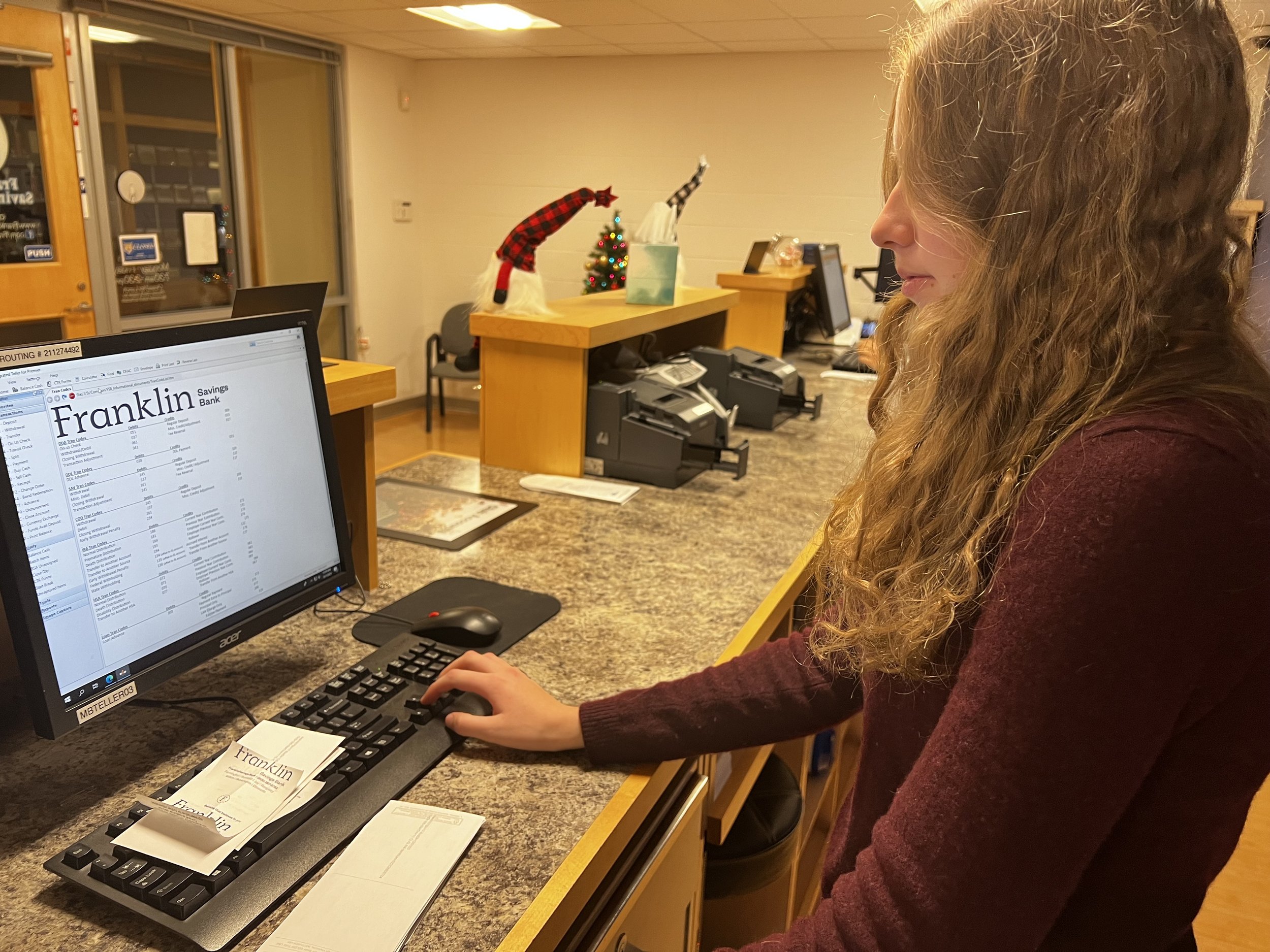

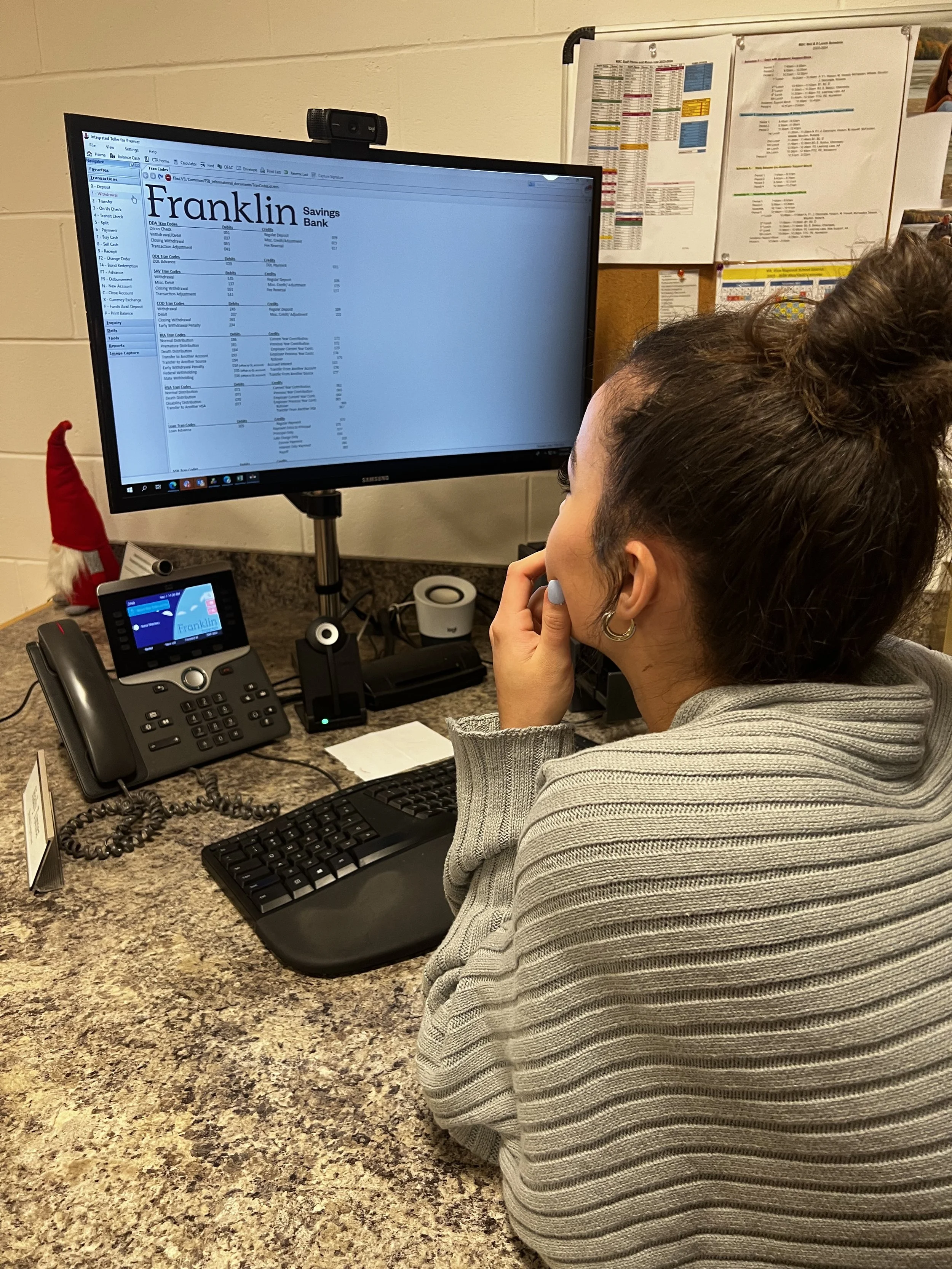

Gain hands-on experience in accurate and efficient cash handling.

Learn transaction processing, including deposits, withdrawals, and fund transfers.

-

Explore various financial products offered by banks, such as savings accounts, loans, and certificates of deposit.

Understand how to educate customers on the benefits and features of different financial products.

-

Understand and adhere to regulatory compliance in the banking industry.

Explore ethical considerations and professional conduct in financial services.

-

Gain proficiency in digital banking tools and technologies.

Explore online banking platforms, mobile banking apps, and electronic fund transfers.

-

Learn techniques for ensuring financial security in banking transactions.

Understand fraud prevention measures and the importance of protecting customer information.

-

Develop skills in cross-selling additional banking products and services.

Understand the principles of relationship building for customer retention.

-

Learn how to educate customers on basic financial literacy concepts.

Develop strategies for promoting financial well-being within the community.

-

Explore career pathways within the banking industry.

Develop a plan for professional development and advancement within the field.

-

Connect with professionals in the banking industry through guest bank professionals, industry visits, and virtual interactions.

Gain insights into career opportunities, industry trends, and potential internship or apprenticeship programs.

-

Engage in simulation exercises and role-playing scenarios to apply learned skills in a realistic banking environment.

Enhance decision-making and problem-solving skills through practical experiences.